Why High-Interest Savings Accounts Matter More Than Ever

In 2025, the financial world is moving faster than ever — inflation pressures, rising living costs, and uncertain markets mean your savings must work smarter.

Parking your money in a regular savings account earning 0.01% interest is no longer a viable strategy if you want to build real wealth.

That’s where high-interest savings accounts come in.

By choosing the right bank, you can grow your money passively, beat inflation, and achieve your financial goals faster — without any risky investments.

If you’re serious about saving smarter in 2025, it’s time to upgrade your savings strategy.

Why You Need a High-Interest Savings Account in 2025

A high-yield savings account offers several advantages beyond just storing your money:

- Compound Growth: Even small balances grow noticeably over time with better interest rates.

- Liquidity: You can access your money whenever needed without penalties.

- Security: Your deposits are usually protected by government insurance programs (like FDIC or their global equivalents).

- Simplicity: No complicated investment knowledge required — anyone can benefit.

Choosing the right savings account could mean earning 50x or even 100x more than a traditional bank account — for doing nothing extra.

(Related: Explore simple ways to save money faster using smart strategies.)

Key Features to Look For in a High-Interest Savings Account

Before you open a new account, pay attention to these important features:

- Annual Percentage Yield (APY): Higher APY = faster growth. Compare rates across banks regularly.

- Minimum Balance Requirements:Some accounts require a minimum balance to earn the top advertised rate — always read the terms carefully.

- Monthly Fees:Prefer accounts with zero fees. High fees can easily eat into your earned interest.

- Accessibility:Mobile banking, online transfers, and ATM access are valuable for modern savers.

- Government Insurance:Make sure the account is insured (like FDIC insurance in the U.S.) or its equivalent in your country.

(Related: Learn how to build your emergency fund strategically for financial safety.)

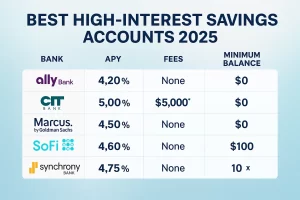

Top 5 High-Interest Savings Accounts to Consider in 2025

(📢 Note: Interest rates mentioned are as of early 2025 and may vary slightly.)

1. CIT Bank Savings Connect

- APY: 4.65%

- Minimum Balance: $100 to open

- Fees: No monthly fees

- Why It’s Great:CIT Bank consistently ranks among the top for competitive interest rates and easy online access. Ideal for automated saving strategies.

2. Marcus by Goldman Sachs Online Savings Account

- APY: 4.40%

- Minimum Balance: None

- Fees: No monthly service fees

- Why It’s Great: Marcus offers a user-friendly experience, zero fees, and reliable customer service — a solid option for beginners and serious savers alike.

3. Ally Bank Online Savings Account

- APY: 4.25%

- Minimum Balance: None

- Fees: No monthly maintenance fees

- Why It’s Great: Ally Bank is known for great customer service, automatic savings tools, and consistently high rates with no hidden fees.

Want to boost your savings even faster?

👉 Check out our guide to automating your savings and investments effortlessly and take action today!

4. Discover Online Savings Account

- APY: 4.30%

- Minimum Balance: None

- Fees: No minimum or monthly fees

- Why It’s Great: Discover offers strong savings rates with the added bonus of 24/7 customer support. It’s a great all-around choice for reliable, hassle-free saving.

5. SoFi High-Yield Savings Account

- APY: Up to 4.50% (with direct deposit)

- Minimum Balance: None

- Fees: No account fees

- Why It’s Great: SoFi offers hybrid savings and checking options with bonus perks like cash back, financial planning tools, and even crypto investing — ideal for tech-savvy users.

(Related: Learn how to maximize your 20% savings allocation using the 50/30/20 rule to grow wealth faster.)

Important Note on Rates and Fine Print

Always review the bank’s latest rate information.

Some promotional rates require specific conditions (like direct deposits or maintaining balances).

Reading the fine print ensures you actually earn the best rate without surprises.

Conclusion: Grow Your Money Smarter in 2025

Choosing the right high-interest savings account is one of the simplest and safest ways to grow your wealth in 2025.

Instead of letting your money sit idle in a low-interest traditional account, take a few minutes today to upgrade your financial future.

Small changes now can lead to major results over time — the earlier you start, the more you earn.

👉 Take your first step today:

Compare rates, open a high-yield savings account, and start building the financial cushion you deserve!