In today’s world of diversified investing, owning property is no longer the only way to profit from real estate. Enter REITs, or Real Estate Investment Trusts — a powerful vehicle that allows everyday investors to earn from real estate without the challenges of being a landlord.

This guide explores what REITs are, how they work, their benefits and risks, and how you can get started investing in them with confidence.

What is a REIT?

A REIT (Real Estate Investment Trust) is a company that owns, operates, or finances income-generating real estate across various sectors—such as commercial offices, shopping malls, warehouses, residential apartments, hospitals, and even data centers.

REITs are structured to collect rent or leasing income, and they are legally required to distribute at least 90% of their taxable income to shareholders as dividends, making them popular among income-focused investors.

How REITs Work

REITs pool capital from numerous investors and use it to purchase and manage real estate properties or mortgages. When you invest in a REIT, you’re essentially buying shares of a company that earns rental income and passes a significant portion of it to you.

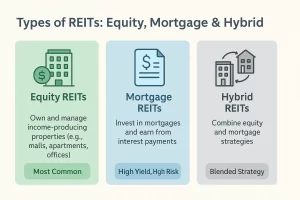

Types of REITs:

|

Type |

Description |

|---|---|

|

Equity REITs |

Own and manage real estate properties, collect rental income. (Most common) |

|

Mortgage REITs |

Invest in mortgages or mortgage-backed securities, earn from interest. |

|

Hybrid REITs |

Combine features of both equity and mortgage REITs. |

Why Invest in REITs?

REITs offer unique advantages that make them attractive to both novice and seasoned investors:

1. Real Estate Exposure Without Ownership Hassles

No dealing with tenants, property taxes, maintenance, or paperwork. REITs provide passive exposure to real estate.

2. Steady Dividend Income

Since REITs must pay out 90% of their income, they tend to offer high dividend yields—a consistent stream of income even during market volatility.

3. Liquidity & Accessibility

Unlike physical property, REITs are traded on major stock exchanges, meaning you can buy or sell them easily like any stock.

4. Portfolio Diversification

REITs give your investment portfolio exposure to the real estate asset class, which often behaves differently from stocks or bonds.

How to Invest in REITs

There are several ways to start investing in REITs, depending on your risk profile and investment preferences:

1. Publicly Traded REITs

These are listed on stock exchanges (like NYSE or NSE). You can buy them through any brokerage account just like individual stocks.

2. REIT Mutual Funds & ETFs

Diversify across multiple REITs with a single investment. These funds track indexes like the FTSE Nareit All REITs Index and reduce exposure to individual REIT risk.

3. Private or Non-Traded REITs

Available through brokers or financial advisors. While they may offer higher returns, they are less liquid and carry higher risks. Due diligence is a must.

REITs: Benefits vs. Risks

|

Benefit |

Risk |

|---|---|

|

Steady, high-yield dividends |

Sensitive to interest rate changes |

|

Passive income generation |

Market volatility for traded REITs |

|

Diversified real estate access |

Sector-specific downturns (e.g., office REITs in a remote work era) |

|

Low entry barriers |

Tax implications on dividend income |

Sample REIT Investment Portfolio (Beginner-Friendly)

|

REIT Type |

Ticker (Example) |

Focus Area |

Risk Level |

|---|---|---|---|

|

Equity REIT |

O (Realty Income) |

Retail, Commercial |

Low-Med |

|

Mortgage REIT |

NLY (Annaly Capital) |

Residential Mortgage |

High |

|

Diversified REIT ETF |

VNQ (Vanguard REIT ETF) |

All Sectors |

Low |

Note: Always consult with a financial advisor before making investment decisions.

Pro Tips for First-Time REIT Investors

- Start small — Invest a small amount via REIT ETFs or fractional shares to get comfortable.

- Check dividend history and payout ratio — This tells you if the REIT is consistent and sustainable.

- Diversify by property sector and geography — Don’t just focus on one region or REIT type.

- Reinvest dividends (DRIP) — Use dividend reinvestment plans to compound growth over time.

- Understand tax treatment — REIT dividends are taxed as ordinary income in most jurisdictions.

If you’ve ever wanted to invest in real estate but lacked the capital, time, or expertise, REITs offer an excellent solution. With low barriers to entry, strong dividend potential, and diversified exposure, REITs empower anyone—from first-time investors to retirees—to grow wealth through real estate passively.

Whether you opt for a standalone REIT or go through a REIT-focused ETF, the most important thing is to align your investment with your financial goals, income needs, and risk tolerance.